Islamabad, January 10, 2026 (Agencies) – Smaller lenders in Pakistan and Japan delivered some of the highest total returns to investors among Asia Pacific banks in 2025, benefiting from strong rallies in local equity markets and improving economic conditions, according to data compiled by S and P Global Market Intelligence.

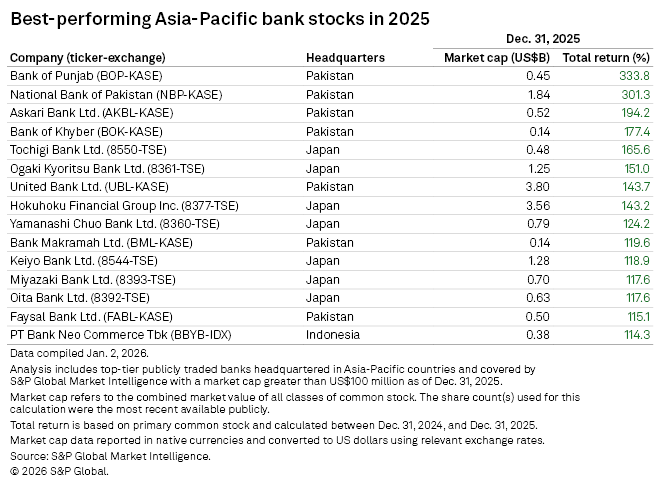

The Bank of Punjab emerged as the top performer among Asia Pacific banks with a market capitalisation above 100 million dollars, reporting total returns of 333.8 percent for investors during 2025. Karachi based National Bank of Pakistan ranked second with total returns of 301.3 percent. Askari Bank Limited and The Bank of Khyber followed, posting gains of 194.2 percent and 177.4 percent respectively. Pakistani banks accounted for six of the top ten positions in the regional ranking.

The strong performance coincided with a continued rally in Pakistan’s equity market. The benchmark KSE 100 index rose for a third consecutive year, gaining 51.2 percent in 2025 to close at a record high. The surge was supported by improved economic indicators, tighter fiscal management and relative political stability. The International Monetary Fund estimated Pakistan’s economic growth at 10.5 percent in 2025, marginally higher than the previous year, while inflation eased to 3.2 percent from 12.6 percent in 2024.

Market Intelligence data showed that more than half of the top ten gainers in the regional analysis had market capitalisations below one billion dollars, highlighting the outsized performance of smaller lenders.

Japanese banks also featured prominently among the top performers. Tochigi Bank Limited ranked fifth with an annual gain of 165.6 percent at a market capitalisation of 480 million dollars. Ogaki Kyoritsu Bank Limited followed with a 151 percent gain, while Hokuhoku Financial Group Incorporated and Yamanashi Chuo Bank Limited also placed among the top ten.

Investor sentiment toward Japanese lenders improved after the Bank of Japan raised its benchmark interest rate by 25 basis points to 0.75 percent on December 19, the highest level in three decades. The central bank said it would continue to normalise monetary policy in line with economic and price improvements, a move expected to support bank profitability through wider interest margins. These actions, combined with the economic policies of Prime Minister Sanae Takaichi’s government, helped lift Japanese equity markets during the year.

In contrast, midsized Indian lenders lagged behind regional peers. Utkarsh Small Finance Bank Limited recorded a 48.6 percent decline in total returns in 2025, while Punjab and Sind Bank fell 42.1 percent and ESAF Small Finance Bank dropped 36.6 percent. Analysts attributed the weaker performance to aggressive monetary easing, which compressed interest margins. The Reserve Bank of India cut its policy rate by a cumulative 125 basis points in 2025, lowering it to 5.25 percent in December.

The steepest loss among regional banks was reported by China’s Bank of Jiujiang Company Limited, whose shares fell 66.9 percent in 2025 amid investor concerns ahead of an equity fundraising announcement late in the year.